Bonus depreciation is a tax incentive that allows small- to mid-sized businesses to take a first year-deduction on purchases of qualified business property in addition to other depreciation. The Section 179 deduction is also a tax incentive for businesses that purchase and use qualified business property, but the two are not the same. In this post we take a look at how both bonus depreciation and Section 179 work and how they differ from each other.

How bonus depreciation works

Generally, the point of depreciation is to spread out the cost of an asset over the life of the asset, rather than take the full cost of the asset in the first year. Bonus depreciation is a kind of accelerated depreciation. In the year qualified property is purchased and put into use, a business is allowed to deduct 100% of the cost of the property in addition to other depreciation that is always available.

Qualified property (or assets) includes:

- Property depreciated under the Modified Accelerated Cost Recovery System (MACRS) that has a recovery period of 20 years or less

- Computer software

- Water utility property

- Qualified film or television productions

- Qualified live theatrical productions

- Specified plants

- Qualified improvement property

- Some listed property

More specifically, property depreciated under the MACRS that has a recovery period of 20 years or less is generally tangible, personal property such as vehicles, office equipment, heavy equipment, machinery, etc. Land does not count as qualified property.

Qualified improvement property is defined by the IRS as “any improvement to an interior portion of a building which is nonresidential real property if such improvement is placed in service after the date such building was first placed in service.”

Listed property, or property that can be used for both business and personal use, must be used 50% of more for business to qualify for bonus depreciation.

Keep in mind, to be depreciable, property must have a “determinable useful life,” meaning that it wears out, loses value, etc. It also must last more than one year. It’s not considered depreciable if it is put into use and disposed of in the same year.

IRS Form 4562 should be used to claim bonus depreciation and Section 179. Keep in mind, for each business or activity on a tax return that requires Form 4562, a separate Form 4562 must be submitted.

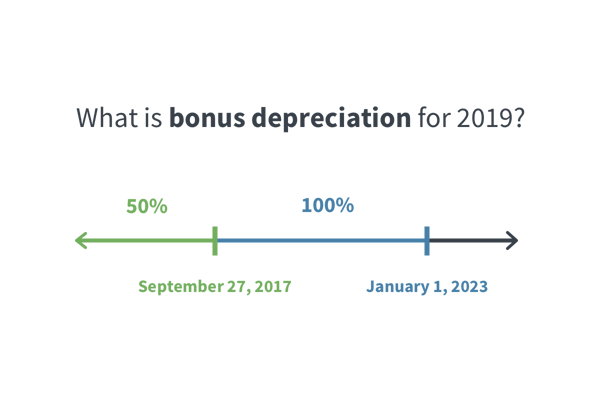

What is bonus depreciation for 2019?

Under the Tax Cuts and Jobs Act, bonus depreciation has been increased to 100% (up from 50%) for purchases of qualified property made between September 27, 2017 and January 1, 2023. Additionally, now used, qualified property acquired and put into use after September 27, 2017 can be depreciable if it meets certain requirements. Previously, only new purchases were eligible for depreciation. The requirements as stated by the IRS for used, qualified property are:

- The taxpayer or its predecessor didn’t use the property at any time before acquiring it.

- The taxpayer didn’t acquire the property from a related party.

- The taxpayer didn’t acquire the property from a component member of a controlled group of corporations.

- The taxpayer’s basis of the used property is not figured in whole or in part by reference to the adjusted basis of the property in the hands of the seller or transferor.

- The taxpayer’s basis of the used property is not figured under the provision for deciding basis of property acquired from a decedent.

- Also, the cost of the used property eligible for bonus depreciation doesn’t include the basis of property determined by reference to the basis of other property held at any time by the taxpayer (for example, in a like-kind exchange or involuntary conversion).

Is bonus depreciation the same as Section 179?

Sometimes the Section 179 deduction is confused with bonus depreciation. After all, they serve similar purposes. But one key difference between the two is that Section 179 allows a business to expense a cost of qualified property immediately, while depreciation allows a business to recover that cost over time. In other words, the Section 179 deduction is taken (unless the business has no taxable profit) first to reduce the cost of the qualified property that was purchased, then bonus depreciation is taken after to decrease the remaining cost of the property over its useful life. Businesses that go over the spending limit for Section 179 can still benefit from taking bonus depreciation.

How Section 179 works

As of January 1, 2018, businesses can deduct up to $1 million of qualified property (up from $520,000 in previous years) immediately, with a phase-out threshold of $2.5 million. Once a tax year exceeds the threshold amount, the Section 179 deduction is reduced dollar-for-dollar by the excess amount. Starting in 2019, the deduction and phase-out threshold amounts will be subject to inflation.

Unlike bonus depreciation, Section 179 is limited to taxpayer’s business income. Passive income, such as assets used in rental property, is not eligible for the deduction. Also, bonus depreciation can push the taxpayer into a net operating loss, but Section 179 cannot. Unlike bonus depreciation, any Section 179 deduction elected that is not allowed due to income limitation is carried forward to future years.

Qualified property for the Section 179 deduction includes:

- Tangible, personal property

- Computer software

- Some listed property

- Qualified improvement property

Qualified improvement property includes improvements to alarms, fire protection and security systems, HVAC, and roofing. It does not include improvements to elevators, escalators, internal structural framework of a building, or enlargement of a building. Notice that HVAC is an example of an asset eligible for Section 179 but not bonus depreciation.

Business owners should document the date of purchase of qualified property, the date the property was put into service, and all costs associated with the purchase. They can elect to take the Section 179 deduction by completing Part I of IRS Form 4562. To elect the deduction for listed property, Part V of Form 4562 should be completed before Part I.

Looking for more information on tax deductions that were revised under the Tax Cuts and Jobs Act? Check out What You Need to Know About the 199A Pass-Through Deduction for 2019.